The Do-It-Yourself (DIY) Investing Service provides clients with a personalized financial plan, a personalized investment plan, a financial checklist, a review of insurance policies, and support and guidance in becoming an effective investor using low-cost index funds. After the initial financial planning project is completed, clients also receive follow-up advice and support at no additional charge.

The basic concept is this: most investors can benefit greatly from enlisting the help and guidance of a financial advisor. However, the optimal long term investment strategy is a “buy right and hold tight” strategy that involves a simple portfolio of low-cost index funds. For this strategy, most of the work and planning is done at the front end, and a minimal amount of work is done thereafter.

Most financial advisory firms want to take control of client assets and manage those assets on an ongoing basis and charge ongoing fees. The fees accrue every single day throughout the duration of the client-advisor relationship, even if almost no work is being done by the advisor. This is great for the advisor and not great for the client. Total fees over an investment lifetime become excessive, and the long-term effect of those fees can be devastating.

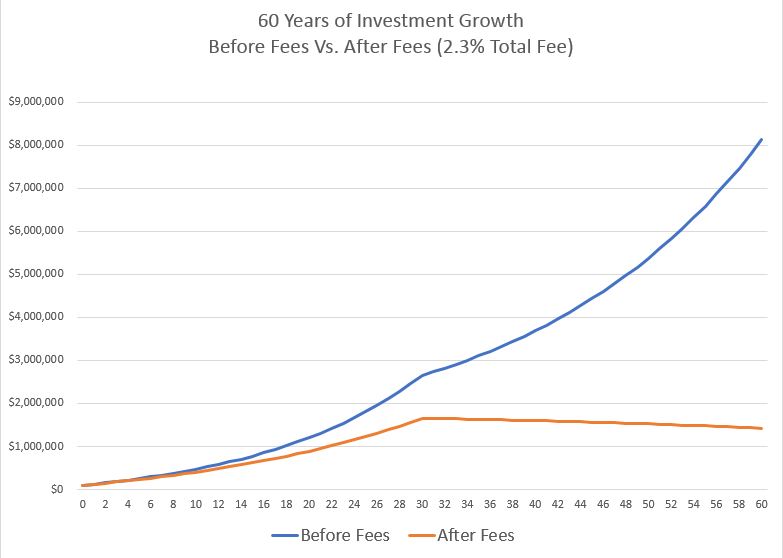

In 2019, Ryan Kelly conducted a study wherein he determined that the average total fee charged by financial advisors is 2.3% per year. You can read an article he wrote about his findings by clicking here.

Let’s consider a 35 year old investor who invests $100,000 with a traditional financial advisor, contributes $20,000 per year for 30 years, and then distributes $50,000 per year for the next 30 years. The investor earns a 7% annual return before fees for the accumulation phase, and then earns a 5% annual return before fees for the distribution phase. The following chart shows the long-term growth of the client’s assets before fees and after fees.

It’s startling to consider the devastating impact of high fees over a very long, 60 year investment lifetime. John Bogle, founder of Vanguard, has said “the miracle of compound interest is overwhelmed by the tyranny of compounding cost.”

Many look for guidance and direction from an experienced investment advisor to ensure they get on the right path, but do not want to pay fees on an ongoing basis. If you fall into this group, the DIY Investing Service may be a good fit for your financial and investment planning objectives.

Ryan Kelly has been one of the pioneers in this “teach a person how to fish” approach to investment advice and financial planning.

DIY Investing Service:

The service involves approximately 14 to 20 total hours of work for the advisor, Ryan Kelly, CFP®. The service is offered for a flat one-time fee of $4,500. It includes three initial Zoom meetings, and also a six-month period of follow-up advice.

There are six elements to the service offering:

- Personalized financial plan. A prudent investment strategy must begin with a written financial plan. It will be written by Ryan Kelly who is a Certified Financial Planner ® Professional. It will be written in a narrative format that is easy to understand. The financial plan will provide you with a road map to help you make better financial and investing decisions going forward. It will also provide guidance and suggestions with any complex financial issues you have.

- Insurance Review. As part of the financial plan, your insurance policies will be reviewed to help you identify any potential deficiencies in your insurance and contingency planning.

- Investment plan. The personalized investment plan will cover each of your investment accounts (401K, IRA, Roth IRA, taxable brokerage accounts, etc) and will list the low-cost index funds (or low-cost ETFs) you should use in each account, the percentage allocations for each index fund, and an investment schedule showing how much to contribute to each account in the future. The investment plan will outline important investing principles to help you stay the course with your plan. If your 401K does not offer low-cost index funds then Ryan will help you identify the best investment options available.

- Financial checklist. A financial checklist will be written to outline the most important action items to implement your financial plan and investment plan.

These first four steps are completed during the initial project, which includes three Zoom meetings. - Help opening the necessary accounts and making the index fund trades. Ryan will guide you through the process of implementing your financial plan and investment plan. He will guide you in opening the necessary investment accounts and executing the index fund trades. He can use the “screen share” feature on Zoom to do this, and will help you feel comfortable and confident being your own investment manager.

Backdoor Roth IRA Help. Are you a high-income earner and want to utilize a Backdoor Roth IRA? Ryan will help guide you through the somewhat complex steps involved. - Six months of ongoing support at no additional charge. You control and manage your investment accounts. Managing your investments is your responsibility. But Ryan is available to help. After your overall plan is implemented, you will receive up to six hours of follow-up advice, over a six-month period, at no additional charge. Near the end of that period, Ryan will proactively reach out for a final follow-up meeting to discuss how the plan is working and answer any questions you have.

After the six-month period has passed, you may hire Ryan, at your own discretion, for a follow-up financial review session. There are multiple options for follow-up financial advice, with fees ranging from $295 to $1,150.

Free 20-Minute Phone Consultation. Ryan offers a free 20-minute phone consultation for those interested in learning more about the DIY Investing Service. You may schedule the consultation by clicking here.