We offer a Do-It-Yourself (DIY) Investing Service. This service provides our clients with a personalized financial plan, a personalized investment plan, a financial checklist, a review of insurance policies, and support and guidance in becoming an effective investor using low-cost index funds. Our clients also receive one-year of financial advice and support at no additional charge.

The basic concept is this: most investors can benefit greatly from enlisting the help and guidance of an investment advisor. However, the optimal long term investment strategy is a “buy right and hold tight” strategy that involves a simple portfolio of low-cost index funds. For this strategy, most of the work and planning is done at the front end, and a minimal amount of work is done thereafter.

Most financial advisory firms want to take control of client assets and manage those assets on an ongoing basis and charge ongoing fees. The fees accrue every single day throughout the duration of the client-advisor relationship, even if almost no work is being done by the advisor. This is great for the advisor and not great for the client. Total fees over an investment lifetime become excessive, and the long-term effect of those fees can be devastating.

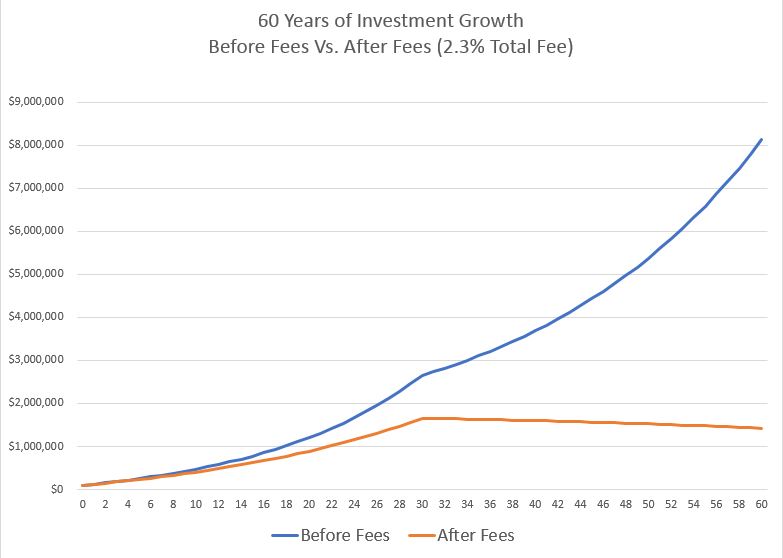

Our research suggests that the average total fee charged by financial advisors is 2.3% per year. Let’s consider a 35 year old investor who invests $100,000 with a traditional financial advisor, contributes $20,000 per year for 30 years, and then distributes $50,000 per year for the next 30 years. The investor earns a 7% annual return before fees for the accumulation phase, and then earns a 5% annual return before fees for the distribution phase. The following chart shows the long-term growth of the client’s assets before fees and after fees.

It’s startling to consider the devastating impact of high fees over a very long, 60 year investment lifetime. John Bogle, founder of Vanguard, has said “the miracle of compound interest is overwhelmed by the tyranny of compounding cost.”

Many look for guidance and direction from an experienced investment advisor to ensure they get on the right path, but do not want to pay fees on an ongoing basis. If you fall into this group, we believe our DIY investing service is for you.

We are one of the pioneers in the “teach a person how to fish” approach to investment advice and financial planning. We believe less than 1 out of 2,000 investment advisory and financial planning firms in the country proactively offer a “project-based” service where they do not try to sell you an investment product or take control of your assets for a perpetual “assets under management” fee.

Our DIY Investing Service:

The service involves approximately 12 to 15 hours of work on our end. We offer this service for a flat one-time fee of $3,300.

There are six elements to our service offering:

- Personalized financial plan. A prudent investment strategy must begin with a written financial plan. Your personalized financial plan will be written by our firm’s president who is a Certified Financial Planner ® Professional. It will be written in a narrative format that is easy to understand. The financial plan will provide you with a road map to help you make better financial and investing decisions going forward. It will also provide guidance and suggestions with any complex financial issues you have.

- Insurance Review. We will review your insurance policies and will help you identify any potential deficiencies in your insurance and contingency planning.

- Investment plan. We will write a personalized investment plan. It will cover each of your investment accounts (401K, IRA, Roth IRA, taxable brokerage accounts, etc) and will list the low-cost index funds you should use in each account, the percentage allocations for each index fund, and an investment schedule showing how much to contribute to each account in the future. The investment plan will outline important investing principles to help you stay the course with your plan. If your 401K does not offer low-cost index funds then we will help you identify the best investment options available.

- Financial checklist. We will write a financial checklist to outline the most important action items to implement your financial plan and investment plan.

- Help opening the necessary accounts and making the index fund trades. We will guide you through the process of implementing your financial plan and investment plan. We will guide you in opening the necessary investment accounts and executing the index fund trades. We help you feel comfortable and confident being your own investment manager.

Backdoor Roth IRA Help. Are you a high-income earner and want to utilize a Backdoor Roth IRA? We’ll help guide you through the somewhat complex steps involved. - One Year of Ongoing Support at No Additional Charge. You control and manage your investment accounts. Managing your investments is your responsibility. But we are here to help if you need us. After your financial plan and investment plan is implemented, you can email or call us with any financial questions over a one-year period at no additional charge. After the one-year period has passed, you may hire us at any time for a follow-up financial review session. We charge a flat fee of $450 for the follow-up financial review session.

Free 20-Minute Phone Consultation. We offer a free 20-minute phone consultation for those interested in learning more about the DIY Investing Service. You may schedule the consultation by clicking here.