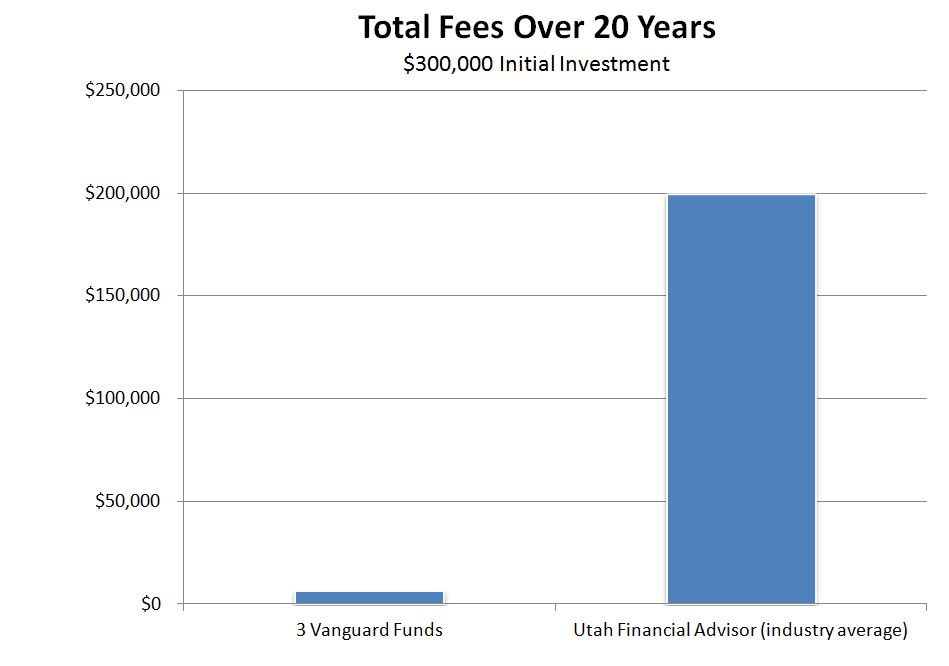

When a investment advisor manages an investment account for a client, there are typically three fee layers: the advisory fee, underlying fund fees, and brokerage commissions. Data we have compiled suggests the average total fee of Utah financial advisors is 2.3% per year.

We believe the index fund is the greatest financial innovation of the last 200 years. The reason is simple: index funds help investors capture their fair share of stock and bond market returns. They also allow investors to build simple, diversified, and tax efficient investment portfolios at an extremely low cost.

Three Vanguard index funds can provide any investor – young or old, poor or rich – with a an efficient and durable portfolio. The three funds are:

- Vanguard Total U.S. Stock (VTI). Total fees are $4/year for every $10,000 invested.

- Vanguard Total International Stock (VXUS). Total fees are $11/year for every $10,000 invested.

- Vanguard Total U.S. Bond (BND). Total fees are $5/year for every $10,000 invested.

We believe investors can be well served by holding these three funds over a long period of time. For example, someone entering retirement could be well served with the following allocation:

40%: Vanguard Total U.S. Stock

20%: Vanguard Total Int’l Stock

40%: Vanguard Total U.S. Bond

Historically, a retirement investor holding these three funds in these allocations has experienced a good investment outcome. (Please note that past is not necessarily prologue. Past performance does not guarantee future results).

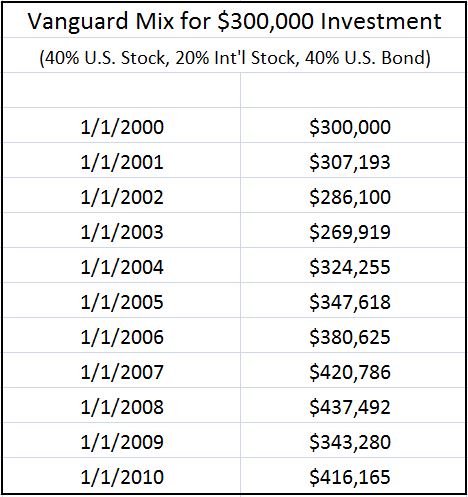

The ten year period of January 1, 2000 to January 1, 2010 was a turbulent time for most investors. Many got lured into tech stocks at the peak, then got out at the bottom and experienced permanent capital loss. Others held a high cost U.S. stock mutual fund and saw no dollar gains over the 10 year period, and in some cases even a slight loss. However, if you purchased these three low-cost Vanguard funds (40% Total U.S. Stock, 20% Total Int’l Stock, 40% Total U.S. Bond) and simply held onto them (with no rebalancing) then you earned a good return on your investment. Here’s an illustrative example:

In absolute terms, the investment performance of the Vanguard mix was mediocre at best for this particular 10 year period. However, in relative terms, the performance was outstanding since the majority of stock investors lost money during this period, and the extremely high fees charged by financial advisors added salt to the wounds of many.

One reason the three Vanguard mix portfolio worked so well is the very small fee drain from the account. Less than $1 for every $1,000 was drained each year in the form of fees. Had this same portfolio incurred fees of 2.3% per year (the fee average for Utah based investment advisors) then $23 for every $1,000 would have been drained each year in the form of fees. This would have meant the portfolio ended with a balance of $334,992 vs. $416,165. Fees make a huge difference in outcomes.

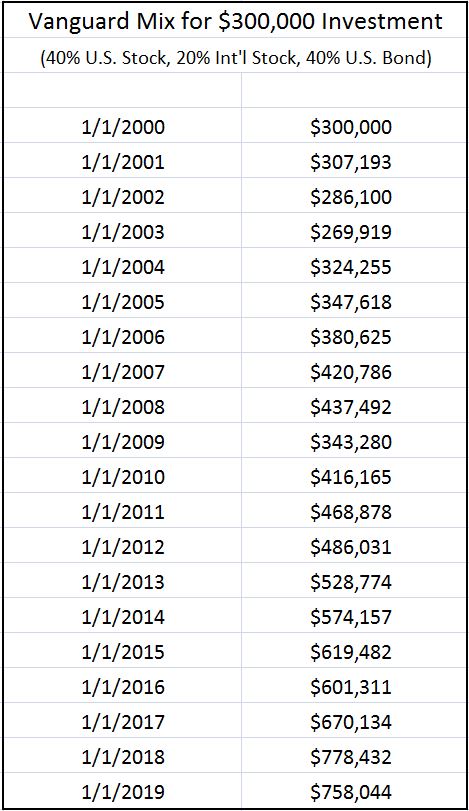

If you followed Vanguard founder John Bogle’s clarion call to “stay to course” then the next nine years (2010 to 2019) have been very good to you for the Vanguard mix portfolio. Here’s the return of this Vanguard mix for the 19 year period from January 1, 2000 to January 1, 2019. Again, this assumes no rebalancing; rather it assumes you bought these three funds in the allocations displayed and held on for 19 years.

The 19 year annual net return for this 3 fund Vanguard portfolio is 5.0% per year or 153% total return. This may seem lackluster, but we offer a few important observations:

- This 19 year period included two 50% S&P 500 declines (2000 to 2002, and 2008 to 2009). This portfolio endured through that market turmoil and still produced a net (after fees) return of 5% per year or 153% total return.

- The beginning of this period was a market peak for U.S. stocks. Despite investing at that peak, this portfolio still did pretty well.

- The U.S. Stock and U.S. International Stock positions, due to the buy and hold approach, have been extremely tax efficient. The net, after tax return is solid.

- In those 50% S&P 500 market declines, this portfolio went down much less. In 2008, for example, the S&P 500 was down 38% while this portfolio was down 22%.

- We are not aware of a single financial advisor who produced, for their clients, a net (after fees) return of 5% per year over this particular 19 year period. Would any financial advisor like to produce data confirming their investments beat, in net and after tax terms, this portfolio? We’d be anxious to know of a financial advisor who outperformed this portfolio in net terms from 2000 to 2019.

“Buy right and hold tight” is an investment approach that works. We do believe that annual rebalancing can minimize risk and may boost returns slightly, but rebalancing takes minimal time and effort.

Active strategies implemented by financial advisors are like trying to find a needle in a haystack. We believe investors are better served when they stop spending so much money and effort using financial advisors to find the needle and instead just buy the entire haystack through low cost index funds. Don’t try and beat the market; rather, try and capture the market returns at a low cost and stay the course for a long period of time.

We can help you use index funds for retirement investing

We hope you would consider hiring us. Our DIY investing service has a onetime fee of $1,400 and provides comprehensive planning for the many issues involved with financial planning. The primary focus will be helping you transition to using low cost index funds for your retirement investing. We can help you use index funds in a disciplined, balanced way that is appropriate for your personal financial situation. We believe the $1,400 spent on our service offers a very compelling “ROI” value proposition.

Please contact Ryan Kelly for a free consultation to learn more about our retirement planning service. Ryan’s contact information is:

801-372-1446

ryan.kelly@rfkcap.com